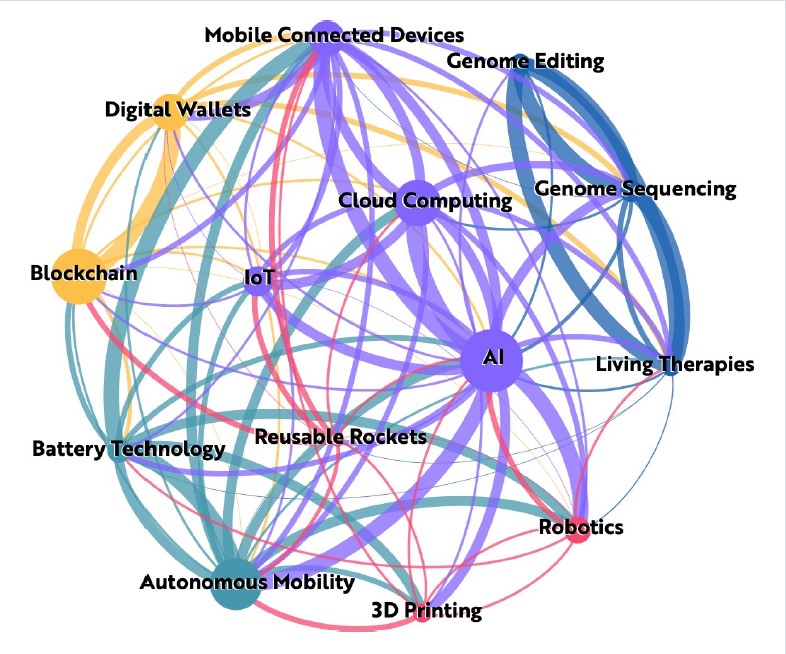

Connecting, Merging, Linking Technologies

The different color lines show how technologies are converging and criss crossing on many levels.

The opportunity to profit from the growth and merging of these technologies is the reason we have created our firms Disruptive Innovative Growth Strategies.

Our endeavor has been to select investments that capature the converging and expoentential growth that is occuring around the World in our investment strategies.

Securities offered through Newbridge Securities Corp., Member FINRA/SIPC. Investment Advisory Services offered through Newbridge Financial Services Group, Inc., an SEC Registered Investment Adviser. Office of Supervisory Jurisdiction: 1200 North Federal Highway, Suite 400 Boca Raton, FL 33432 (954) 334-3450. Zoellner Whole Financial, Newbridge Securities Corp. or NFSG is not affiliated with Estate Planning Team, Inc. http://www.newbridgesecurities.com http://www.brokercheck.org http://www.finra.org http://www.sec.org.http://www.sipc.org. Recommendations made by members of the Estate Planning Team, including the Deferred Sales Trust or other tax, legal or estate planning strategies should not be construed to be endorsed by Newbridge Securities Corporation or Newbridge Financial Services Group, Inc.